Are you unsure of the accuracy of the information on a tax notice you’ve been presented with, or do you need to check the validity of a tax notice as part of a business process?

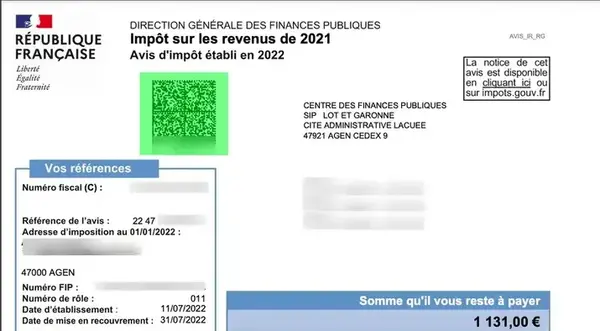

Our “Vérification avis d’imposition français” product enables you to extract the information encoded in the document, along with security keys validating its authenticity, and compare it with the information printed and visible on the document.

How does the online tax notice verification service work?

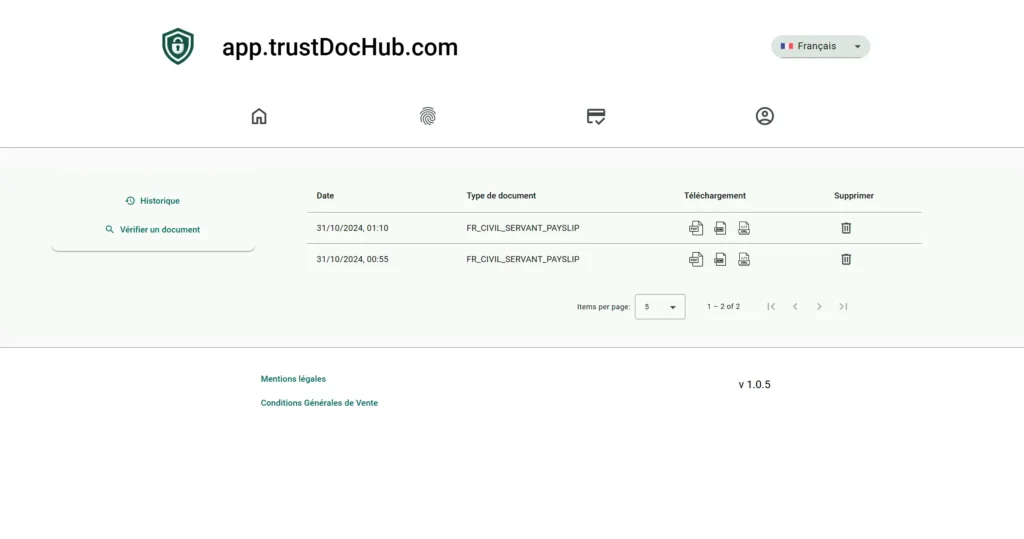

After validation of your purchase, you will receive an email with the credentials to connect to our web resource application (check in spam a few minutes after purchase if you have not received the activation email).

You’ll then have access to the various tools available, including verification of proof of income: simply send the document from the web application, and the results are available immediately.

Full details can be found on the Suite web resources product page.

Professionals, do you need validation by API or web application?

We also offer a service for verifying all proofs of identity or resources via API and our web application.

You can find all the details on these links :

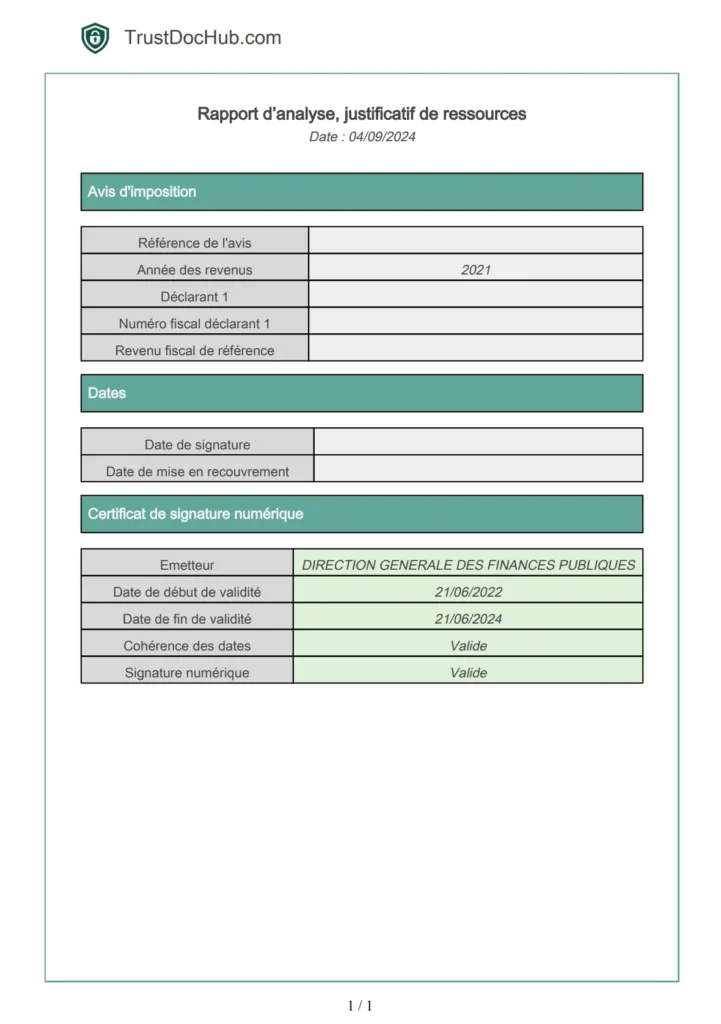

How are the results of the online tax notice check presented?

The results of the analysis are available for download from the history of the resource suite in PDF / JSON / XML format:

Is it possible to test the tax notice verification service online before purchase?

Yes, of course! Two proof of resources checks are offered, you just have to make the request at the following address: request a free trial.

(Check spam one day after the request if you have not received the activation email).

What document formats are accepted?

You can send your documents as PDF documents (this is the standard export format of the tax website).

How to check the veracity of a tax notice?

There are several ways to check a French tax notice: you’ll find all the details in this detailed article!

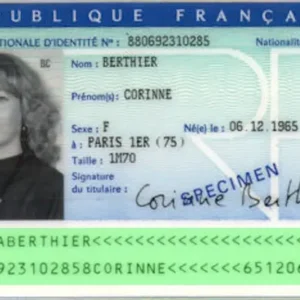

Tax notices feature a 2D-Doc code encoding all the important information on the document, which can be read and compared with the information on the document itself (which is easy to modify with a little technical know-how).

What data is extracted?

The data extracted as part of an online tax notice check are as follows:

- Tax notice:

- Review reference

- Year of income

- Publication date

- Signature date

- Reference tax income

- Number of shares

- Notifiable 1

- Tax number 1

- Declarant 2

- Tax number 2

- Date of collection

- Digital certificate:

- Transmitter

- Validity start date

- End date

- Digital signature

Am I charged if the information is not retrieved correctly from the income tax notice?

The answer is no! Only a document that has been correctly recognized is billable!

If the attachment is not detected or is detected incorrectly, you are not charged: only a successful analysis is deducted from your verification credits.

Personal data

You can delete all data once the report has been downloaded: simply delete the analysis from the web interface history!

Data is also automatically deleted after 3 months.

You can find detailed information about personal data on our dedicated page: Privacy policy.

Terms and conditions of sale

You can find the details of our general terms and conditions of sale at the following address: TrustDocHub T&Cs.

Reviews

There are no reviews yet.